Growing environmental consciousness has sparked momentum, government incentives and advancements in green technology. As a country goes into green mobility at the one end, at the other there is an equally powerful demand for locally manufactured high-performance EV components.

The article covers an in-depth appraisal of the Indian EV component market, highlighting emerging trends, diversification by markets, regional insights, market numbers for the past five years, information about the top players from India, the market outlook, the problems that are being faced, and the final conclusive view towards the way ahead.

- Market Trends:

The Indian EV components market is in the middle of a boom due to many demand-side and supply-side factors. There are some of the key trends affecting this market:

- Policy Support and Incentives

The Indian government under schemes like FAME II (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) and PLI (Product Linked Incentive) for Advanced Chemistry Cell (ACC) batteries has played a vital role in creating an ecosystem conducive to indigenous EV component manufacturing.

- Technology Evolution

There’s a noticeable shift happening in EV batteries, moving from traditional lead-acid types to more advanced lithium-ion (Li-ion) and lithium iron phosphate (LFP) batteries. At the same time, technologies like silicon carbide (SiC) inverters and smart Battery Management Systems (BMS) are becoming common features in newer, more sophisticated electric vehicles.

- Demand from two or three wheelers

In India, the swift growth of electric vehicles is mainly driven by two and three-wheelers. This surge is creating a strong demand for parts that are both efficient and affordable, such as brushless DC (BLDC) motors, smaller battery packs and lighter frame designs.

- Localization of supply chains

To reduce reliance on imports, especially from China, Indian companies are putting more effort into locally developing and manufacturing key components like BMS, inverters and traction motors. This push for localization is helping to build a more self-sufficient EV supply chain in the country.

- Market Segmentation:

By Component Type

- Battery Packs: They act as a source of power for EVs and the L-ion batteries (NMC, LFP) provide high energy density, whereas lead-acid batteries are inexpensive to procure. Their functioning determines range, charging time and overall efficiency of the vehicle.

- Electric Motors: BLDC (Brushless DC) motors and PMSM (Permanent Magnet Synchronous Motors) along with AC Induction motors power the electric vehicles, each having different efficiency and torque characteristics. PMSMs are high in power density, whereas AC Induction motors are robust and require minimal maintenance.

- Motor Controllers & Inverters: This control and manage the frequency and voltage to be supplied to the electric motors, to achieve speed and torque control. The inverters transform DC power from the battery to AC power for motor operation, in the process.

- Battery Management System (BMS): A BMS monitors and controls the health of the battery, to ensure safe operation through managing its temperature, voltage and charging cycle. It also prevents overcharging and overheating, so that the life-span of the battery gets extended.

- Onboard Chargers & DC-DC Converters: Onboard chargers provide efficient AC to DC conversion for battery charging, while DC-DC converters distribute power from the high-voltage circuit to the low-voltage circuit.

- Thermal Management Systems: Such systems take care of temperatures in EV parts so energy is not wasted because of heat. Better cooling also means that batteries and motoVehicle Control Units (VCUs), Just like a ‘brain’ of a car, the VCUs of the EV dictate the running, the use of power and the driving. They decide safe and efficient driving by gathering messages from various sensors will be able to operate for a longer time and the car will be in good condition.

- Telematics and Connectivity Modules: They give a provision for the smart exchanges between the electric vehicles, the fleet operators and the charging stations through GPS, the cloud analytics and remote diagnostics. They represent the ideal means of indicating the state of performance and the servicing needs.

By Vehicle Type

- Electric Two Wheelers: This category covers scooters and bikes that are created for urban mobility needs and are a budget-friendly and environmentally-friendly transportation. They are generally equipped with smaller battery packs and lighter frames to enhance the efficiency.

- Electric Three-Wheelers: E-rickshaws and cargo loaders serve as last-mile transportation solutions, widely adopted in commercial and passenger segments. They provide affordability and operational efficiency for short-distance travel.

- Electric Passenger Cars: These include hatchbacks, sedans and SUVs designed for personal and fleet use, offering improved range and performance. Their advanced battery technology and fast-charging capabilities make them increasingly viable alternatives to conventional cars.

- Electric buses and LCVs: Electric buses and light commercial vehicles (LCVs) are meant for mass transit and goods delivery which also make significant cost savings on fuel and maintenance besides meeting their main purpose. They also decrease urban air pollution and are environmentally friendly public transport.

By the End user

- OEM (Original Equipment Manufacturers): Such companies are those who design, manufacture and assemble EV components and vehicles besides ensuring quality control and technological advancements. Their role in EV innovation and mass adoption is very crucial.

- Aftermarket Suppliers: The suppliers are those who provide the replacement parts, the upgrades and the maintenance services for EVs as well as supporting the longevity and customization of EVs. Consumer needs that are always changing require performance efficiency and affordability and these suppliers are those who meet those needs.

- Market Overview:

In 2024, the size of the Indian market for electric vehicle components was USD 4.0 billion. According to IMARC Group’s forecast, the market would increase at a compound annual growth rate (CAGR) of 17.29% from 2025 to 2033, reaching USD 17.0 billion. The market expansion is mostly being driven by the development.

- Five-Year Market Data:

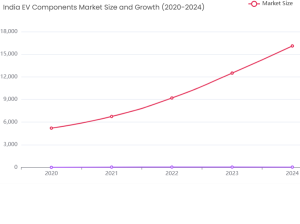

India’s EV components market has seen strong growth over the last five years, mirroring the overall trends in EV adoption.

India’s EV Components Market Growth (2020-2024) A five-year trend showing market size (INR Crore) & growth.

The market is expected to keep a CAGR of 25% over the next five years, supported by initiatives from both the public and private sectors.

The market is expected to keep a CAGR of 25% over the next five years, supported by initiatives from both the public and private sectors.

- Regional Insights:

India’s vast geography presents regional patterns in the EV component market.

Western India (Maharashtra, Gujarat)

Known for strong industrial infrastructure and also in the proximity of ports, western India is an important hub for the exports of EV components. Heavy investments into infrastructure for EVs as well as EV components have been coming in Mandal Becharaji, Gujarat and Pune region, Maharashtra.

Southern India (Tamil Nadu, Karnataka)

Clusters of autos and EV tech lie here. Bengaluru and Chennai are where EV startups and research labs focus on power electronics, battery technology and motor design.

Northern India (Delhi NCR, Uttar Pradesh, Haryana)

High levels of EV adoption, particularly in the two and three-wheeler segment. This northern Indian region is also capitalizing on state subsidies and has witnessed expansion in charging infrastructure.

Eastern and North Eastern India

Slowly emerging but offering long-term potential, especially for cheap e-rickshaws and small EV solutions deployed for rural mobility.

- Indian Key Players:

Numerous Indian companies are turning into leaders in manufacturing cost-efficient, high quality EV components:

- Tata AuoComp Systems

The automotive component division of the Tata Group markets battery packs, motors and thermal systems. In addition, the company has Jv arrangements with various international technology manufactures for advanced EV solutions.

- Exide Industries and Amara Raja

Both these companies are traditionally known for lead acid batteries, and now the same ar venturing into Li-ion battery recycling with new investments towards gigafactory.

- Greaves Cotton(GEMPL)

Greaves is one of the largest suppliers of e-mobility solutions, including electric powertrains, controls and motors mainly for the three-wheeler segment.

- Lucas TVS

Developing inverters, onboard chargers and EV control systems on two-wheelers and on passenger vehicles indigenously.

- Sona BLW Precision Forgings

Offers high-efficiency traction motors, differential assemblies and EV gear systems to global and Indian OEMs.

Other notable names that come to mind include Ather Energy (in-house development), Ola Electric (battery & motor R&D), Hero Electric and Servotech Power Systems.

Future Outlook:

The EV component market in India is slated to undergo big changes between 2025 and 2030. Growth will come through PLI-supported gigafactories for battery production, investment in AI-integrated vehicle control units and telematics, advancements in second-life batteries and recycling, domestic development of silicon carbide chips for power electronics and proliferation of high-voltage EVs especially inter-city logistics and buses.

Amid increasing electric vehicle penetration across the globe, India can make a case with motor controllers, battery management systems, thermal solutions as its leading export items to emerging markets in Africa, Southeast Asia and Latin America.

Limitations and Challenges:

Between 2025-30, the Indian EV components market will witness growth, thanks to battery production supported by PLI, AI-integrated control units, battery recycling, and the development of silicon carbide chips domestically, and high voltage EVs meant for logistics. There is also a huge potential to export motor controllers, BMS and thermal systems to emerging markets.

Yet, some of the roadblocks in this industry include import dependence for lithium, cobalt and electronics, limitations in R&D for high-voltage batteries, high costs for setting up, a shortage of specialised engineers and the absence of technical guidelines on a standardized basis, making scaling inefficient.

Conclusion:

The components market for electric vehicles in India is set on a passionate growth runway sustained by the integrity of policy, innovation and demand. It has built some solid progress in motor, battery and power electronics manufacturing via localization; however, becoming a global EV component powerhouse will depend on how well India bridges its skill gaps, raw material security and technology standardization.

With the right kind of strategy and tie-ups, India can supply its mobility needs and become a major exporter of EV components on the world green mobility map.